Brazil's Banks Adjust View of Their Market

Por um escritor misterioso

Last updated 06 julho 2024

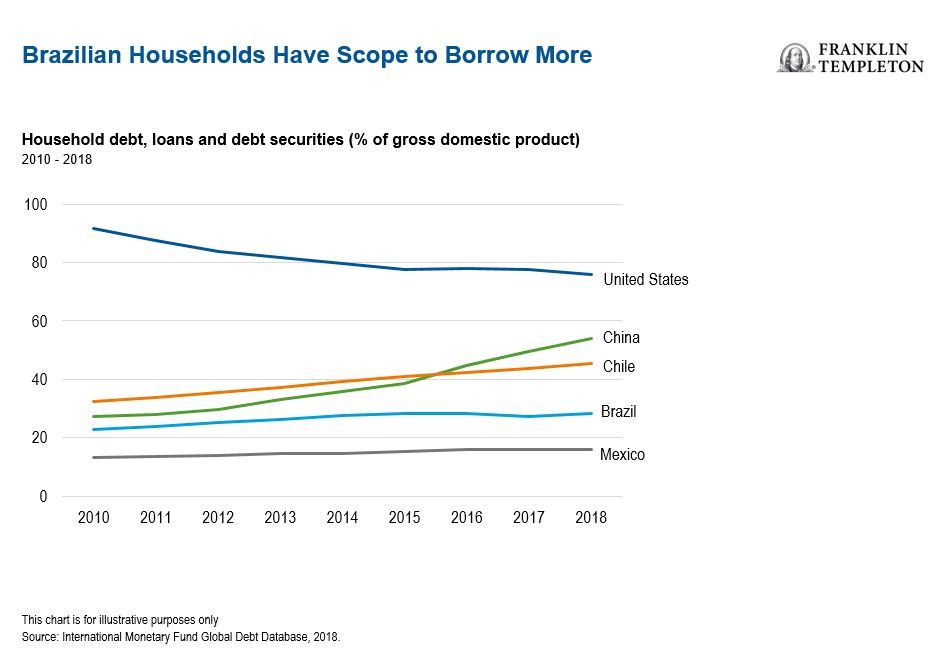

Dick Meyer speculates that big countries like Brazil which are making large investments in IT may quickly expand microfinance through commercial banks and eventually outpace other countries that have invested in NGOs and other specialized microfinance institutions. He quotes a New York Times article which explains how for decades, banks in Brazil almost exclusively catered to the middle and upper classes, aiming at a small but wealthy minority in a country with one of the world's most skewed income gaps. That is now starting to change, in part because Brazil's moneyed classes are already over-served by banks. That, analysts say, means the growth potential for financial institutions at the high end of the market is diminishing and they are waking up to the fact that the low-income classes are going to be the biggest source of growth for the future. Under new rules, banks can set up kiosks and banking terminals in supermarkets and drugstores instead of opening and running new branches. Because Brazil's banks are highly automated, these terminals tend to be inexpensive to operate, making it easier for banks to get a return on their investment. To encourage lending to the poor, the government also allows banks to use up to 2 percent of reserve requirements - money that would otherwise be parked at the central bank - to offer low-interest loans to low-income customers. Banks like the privately owned Lemon Bank in São Paulo that operates exclusively through automated teller machines in outlets like bakeries and corner stores, are more interested in providing basic financial services than in offering credit. "There's a lot of romanticizing about credit," said Michael Esrubilsky, Lemon Bank's general manger. "What our client really needs is convenience to pay bills, to not have to spend an hour to get to the nearest bank and to not have to spend 10 reais on transportation to get back and forth."

A banner for Banco Santander Brasil covers the facade of the New

A Positive Tipping Point for Some Brazilian Banks?

EMERGING MARKETS-Argentina's peso drops over 50% with devaluation

PDF) Access to Finance: An Unfinished Agenda

Brazil Central Bank Reinforces Cautious View on Fight to Bring

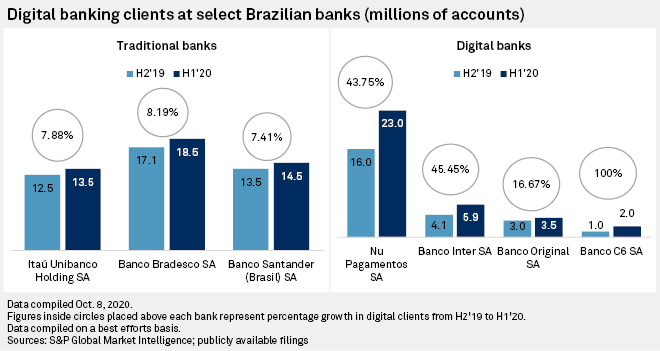

Fintechs, big banks on a quest for digital clients in Brazil

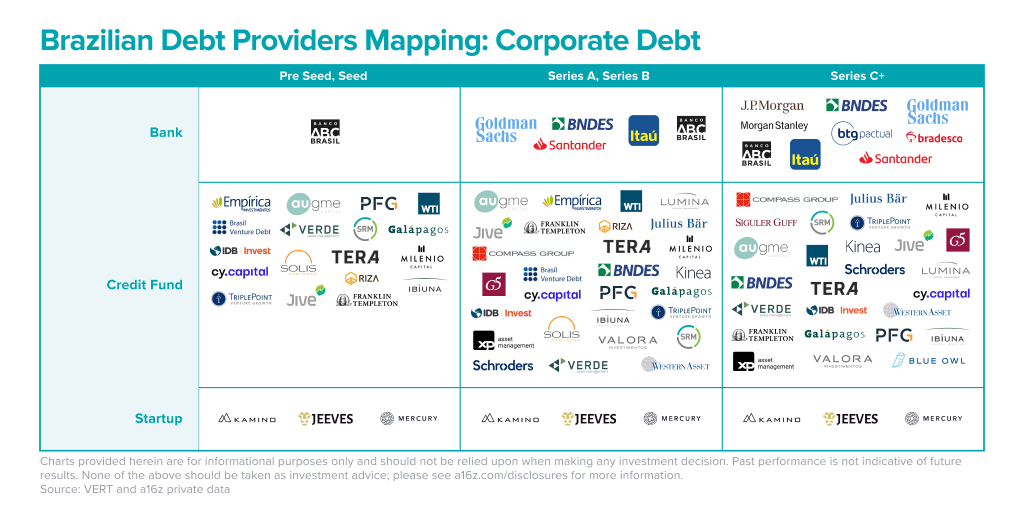

A Market Map of Brazil's Credit Landscape

Brazil's banks adjust risk appetite as inflation threatens asset

Brazil's biggest banks battle for reinvention in digital era

The Brazil Central Bank Will Maintain Its 50 Basis Point Reduction

Brazil's Banks Adjust View of Their Market

Brazil: Development news, research, data

Brazil's biggest banks battle for reinvention in digital era

Public Policy Notes - Towards a fair adjustment and inclusive growth

Recomendado para você

-

Free Course: Explorando os recursos educacionais da Khan Academy from Fundação Lemann06 julho 2024

Free Course: Explorando os recursos educacionais da Khan Academy from Fundação Lemann06 julho 2024 -

Os 6 MELHORES Férias em Auto-atendimento em Nova Iorque, Nova Iorque (NY), Estados Unidos da América em 202306 julho 2024

-

Free Course: Select Topics in Python: Natural Language Processing from Codio06 julho 2024

Free Course: Select Topics in Python: Natural Language Processing from Codio06 julho 2024 -

Brazil central bank to tighten digital asset regulation amid 44% spike in investment - CoinGeek06 julho 2024

Brazil central bank to tighten digital asset regulation amid 44% spike in investment - CoinGeek06 julho 2024 -

BRAZIL: The Struggle for Black Education in Salvador06 julho 2024

BRAZIL: The Struggle for Black Education in Salvador06 julho 2024 -

Unexpected demand leads to website breakdown of Brazil Central Bank06 julho 2024

Unexpected demand leads to website breakdown of Brazil Central Bank06 julho 2024 -

MS conquista 1° lugar no Prêmio de 'Boas Práticas do Brasil Central' - Rede Educativa MS06 julho 2024

MS conquista 1° lugar no Prêmio de 'Boas Práticas do Brasil Central' - Rede Educativa MS06 julho 2024 -

CLAS Comunica São Paulo SP06 julho 2024

-

Brazil's New Middle Class: A Better Life, Not An Easy One : NPR06 julho 2024

Brazil's New Middle Class: A Better Life, Not An Easy One : NPR06 julho 2024 -

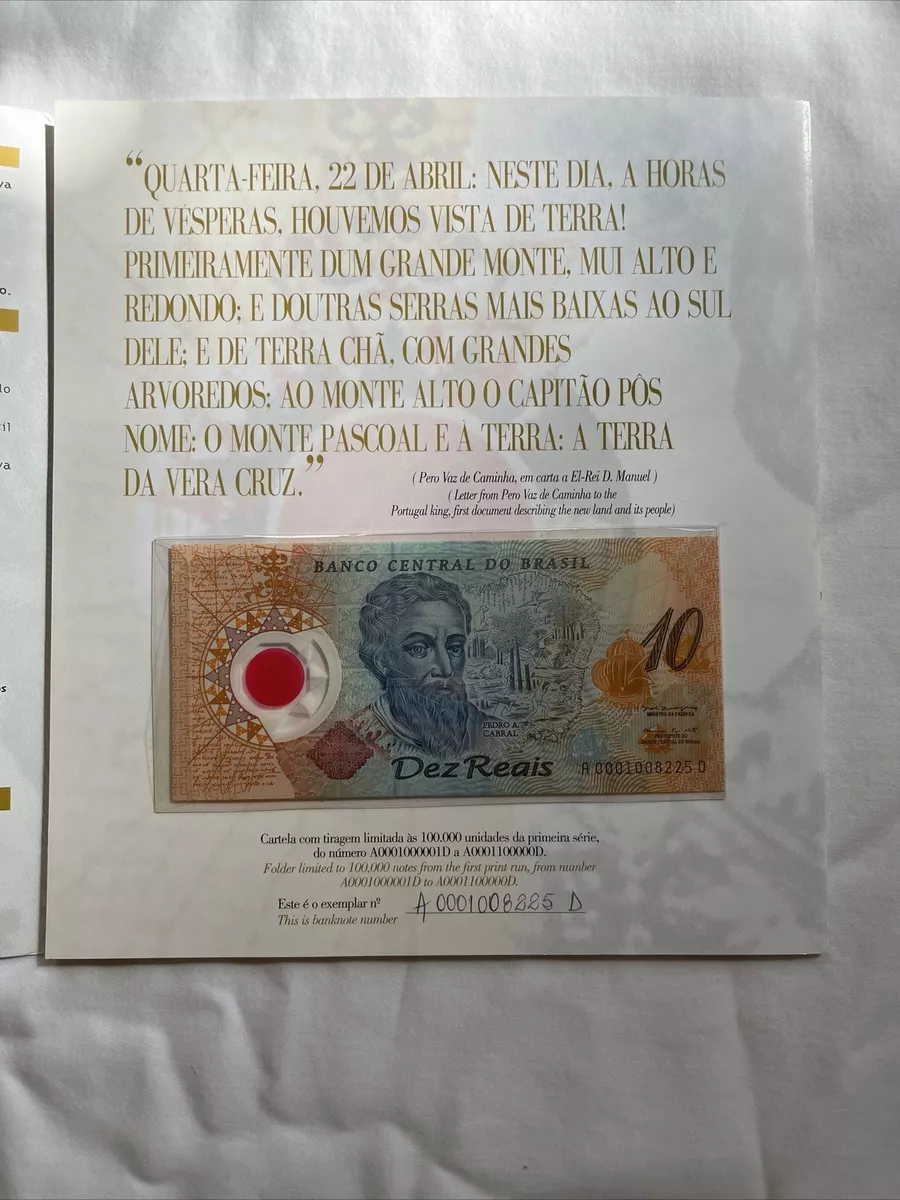

Commemorative Banknote Of The Fifth Centenary Brazil 10 Reals06 julho 2024

Commemorative Banknote Of The Fifth Centenary Brazil 10 Reals06 julho 2024

você pode gostar

-

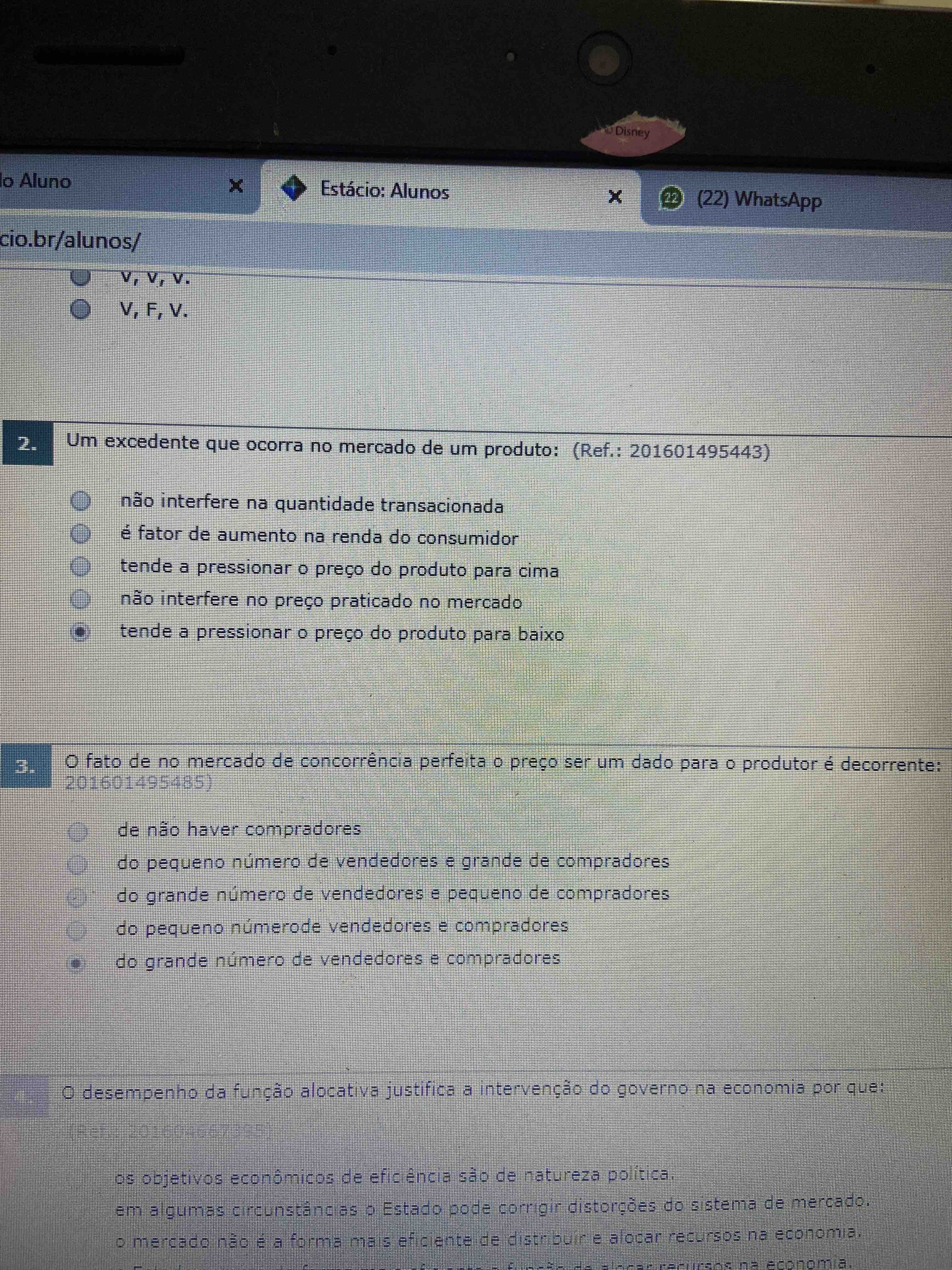

um excedente que ocorra no mercado de um produto - Economia Política06 julho 2024

um excedente que ocorra no mercado de um produto - Economia Política06 julho 2024 -

FC Salgados & Docês (@fcsalgadosfl_official) • Instagram photos06 julho 2024

-

Invincible Fan Cast Portraits - Fan Art - Media Chomp06 julho 2024

Invincible Fan Cast Portraits - Fan Art - Media Chomp06 julho 2024 -

Persona 5: The Phantom X, Megami Tensei Wiki06 julho 2024

Persona 5: The Phantom X, Megami Tensei Wiki06 julho 2024 -

) Conjunto Bebê Menina Body e Saia Ursinho Branco/Rosa06 julho 2024

Conjunto Bebê Menina Body e Saia Ursinho Branco/Rosa06 julho 2024 -

ALITRADE HYPERMART06 julho 2024

ALITRADE HYPERMART06 julho 2024 -

How to catch Spiritomb in Pokémon Brilliant Diamond and Shining Pearl - Dot Esports06 julho 2024

How to catch Spiritomb in Pokémon Brilliant Diamond and Shining Pearl - Dot Esports06 julho 2024 -

Video- videodo homem-aranha (ps, discs), com disco para jogos06 julho 2024

Video- videodo homem-aranha (ps, discs), com disco para jogos06 julho 2024 -

Aparelho de Jantar, Chá e Café Porcelana Schmidt 42 peças - Dec. Tais 2247 - SCHMIDT06 julho 2024

Aparelho de Jantar, Chá e Café Porcelana Schmidt 42 peças - Dec. Tais 2247 - SCHMIDT06 julho 2024 -

codigos do dinossauro do google|Pesquisa do TikTok06 julho 2024

codigos do dinossauro do google|Pesquisa do TikTok06 julho 2024