Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 05 julho 2024

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

What is dual residence? Low Incomes Tax Reform Group

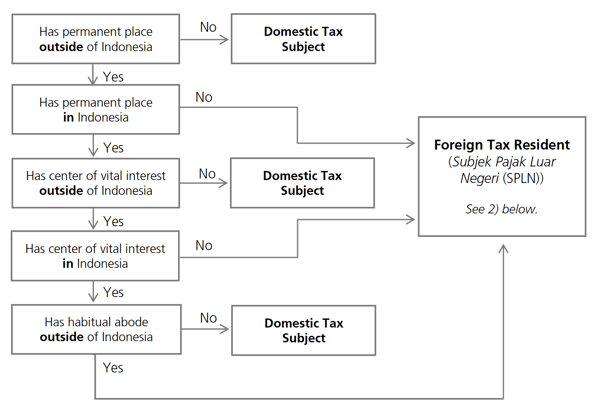

Indonesia's Omnibus Law - Individual Tax Subjects

BoldenITS – Just another WordPress site

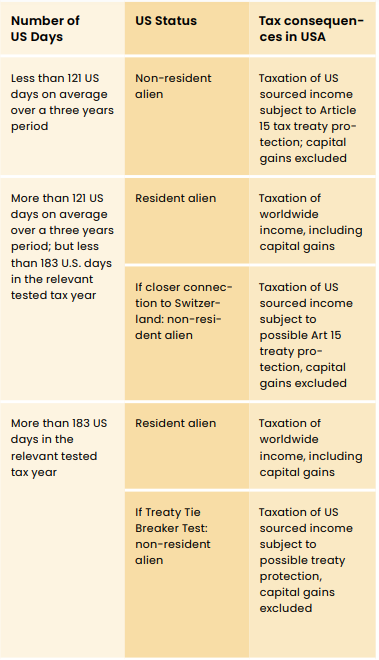

Expansion into the USA: dos and don'ts from a tax point of view - Lexology

Tax treaty: Demystifying Tax Treaties: How They Affect Expatriation Tax - FasterCapital

Dual residence and tax treaties' tie-breaker rules: Can a temporary accommodation amount to habitual abode?

Tie Breaker Rule in Tax Treaties

India - The Dilemma Of Dual Residence – Can Vital Interests Fluctuate Overnight? - Conventus Law

MN Tax & Business Services

Canadian Snowbirds and U.S. Income Tax

U.S. Australia Tax Treaty (Guidelines)

Residency test under taxation treaty

Tax considerations for Canadian snowbirds

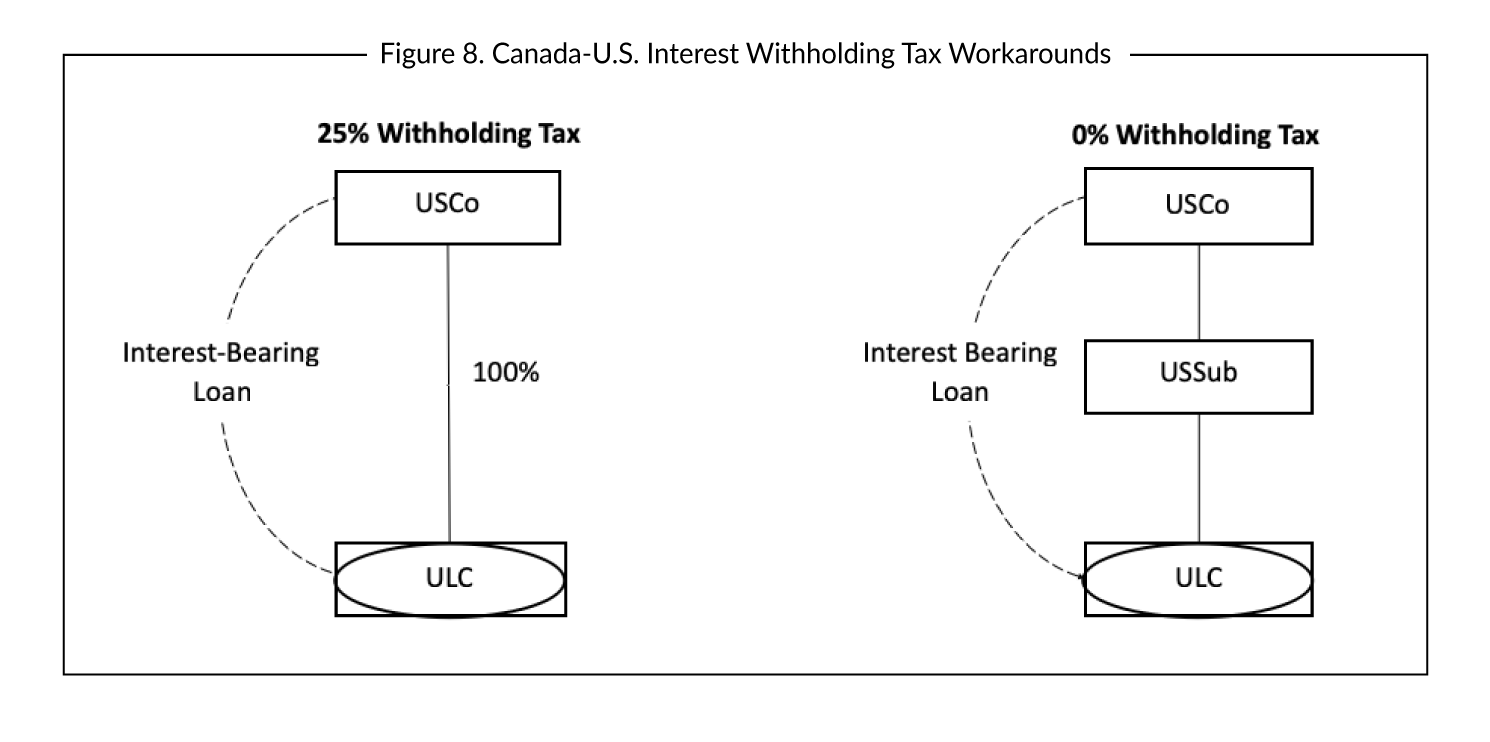

Tax Treaties Business Tax Canada

Treaty Tiebreaker Rule vs Closer Connection: Tax Avoidance Rules

Recomendado para você

-

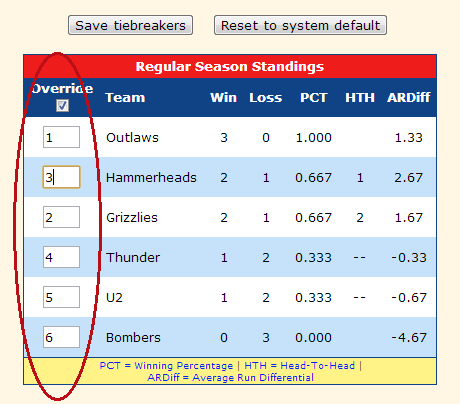

Tie-Breaker Configurations Download Scientific Diagram05 julho 2024

Tie-Breaker Configurations Download Scientific Diagram05 julho 2024 -

Tie-Breaker Help Guide05 julho 2024

Tie-Breaker Help Guide05 julho 2024 -

Tiebreaker Quiz Questions - Free Pub Quiz Trivia - Perfect For Any Event05 julho 2024

Tiebreaker Quiz Questions - Free Pub Quiz Trivia - Perfect For Any Event05 julho 2024 -

Tie Breaker Oregon05 julho 2024

-

Tie-Breaking Criteria revised for NEET PG 202105 julho 2024

Tie-Breaking Criteria revised for NEET PG 202105 julho 2024 -

Tiebreaker (Short 2019) - IMDb05 julho 2024

Tiebreaker (Short 2019) - IMDb05 julho 2024 -

Rigs on Biz…Relationships, Your Secret Tie Breaker (491 words) - Ed Rigsbee association and membership growth05 julho 2024

Rigs on Biz…Relationships, Your Secret Tie Breaker (491 words) - Ed Rigsbee association and membership growth05 julho 2024 -

Tie Breaker Chalkboard Pregnancy Announcement - Set of 3 Printable Photo Props / Baby Announcement / Chalkboard Signs / Tie Breaker Coming05 julho 2024

Tie Breaker Chalkboard Pregnancy Announcement - Set of 3 Printable Photo Props / Baby Announcement / Chalkboard Signs / Tie Breaker Coming05 julho 2024 -

Our Tie-breaker Baby05 julho 2024

-

TieBreaker - Bezier Games05 julho 2024

TieBreaker - Bezier Games05 julho 2024

você pode gostar

-

Jogo Você Sabia? - Estrela05 julho 2024

Jogo Você Sabia? - Estrela05 julho 2024 -

Resident Evil Village': sharper and scarier for new consoles - Los05 julho 2024

Resident Evil Village': sharper and scarier for new consoles - Los05 julho 2024 -

300 This is Sparta! Ciudad del pecado, Cine, Mejores peliculas05 julho 2024

300 This is Sparta! Ciudad del pecado, Cine, Mejores peliculas05 julho 2024 -

Pião Bico de Lançadeira05 julho 2024

Pião Bico de Lançadeira05 julho 2024 -

T- Shirt ROBLOX (Girl) Roblox shirt, Roblox t shirts, Roblox05 julho 2024

T- Shirt ROBLOX (Girl) Roblox shirt, Roblox t shirts, Roblox05 julho 2024 -

CRAFTING NEW ILLUSIONIST Units In Anime Fighters! TRANSFER OP DRIP Units!05 julho 2024

CRAFTING NEW ILLUSIONIST Units In Anime Fighters! TRANSFER OP DRIP Units!05 julho 2024 -

Xbox Series X 1TB w/Microsoft Carbon Black Wireless Controller and Rig 800 PRO HX Wireless Headset and PDP Remote05 julho 2024

-

Matheus Araújo diz não pensar no profissional do Corinthians agora05 julho 2024

Matheus Araújo diz não pensar no profissional do Corinthians agora05 julho 2024 -

Wednesday Addams05 julho 2024

Wednesday Addams05 julho 2024 -

Genjitsu Shugi Yuusha no Oukoku Saikenki' Part 2 Announced for05 julho 2024

Genjitsu Shugi Yuusha no Oukoku Saikenki' Part 2 Announced for05 julho 2024