Variable Interest Entities (VIE): Definition and How They Work

Por um escritor misterioso

Last updated 06 julho 2024

:max_bytes(150000):strip_icc()/variable-interest-entity.asp-final-2cd3c71675e94965b5c65f888e5d7b00.png)

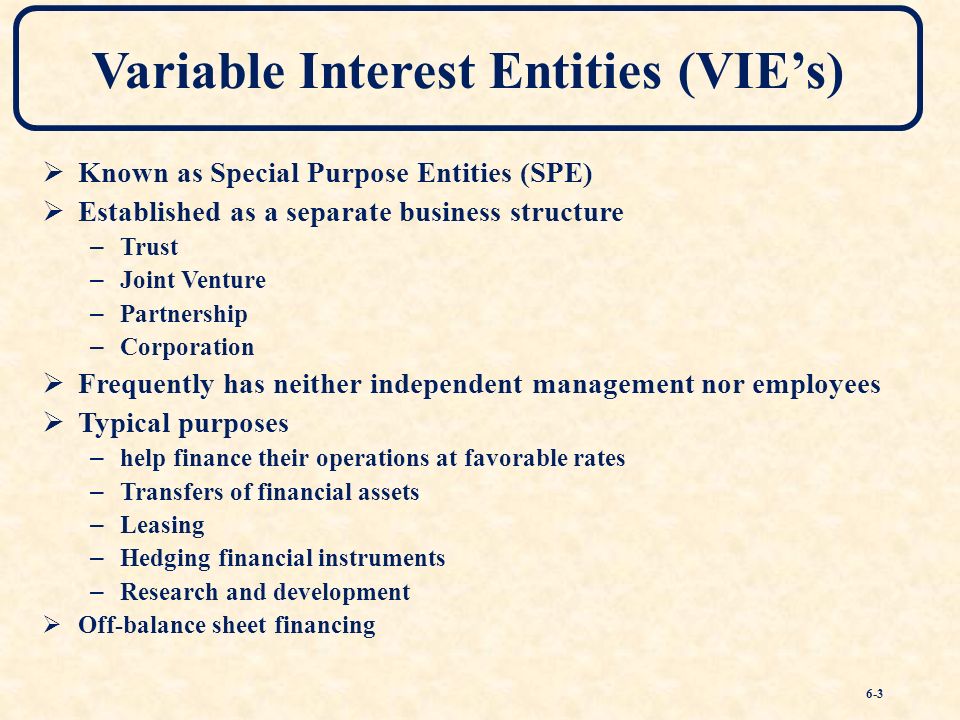

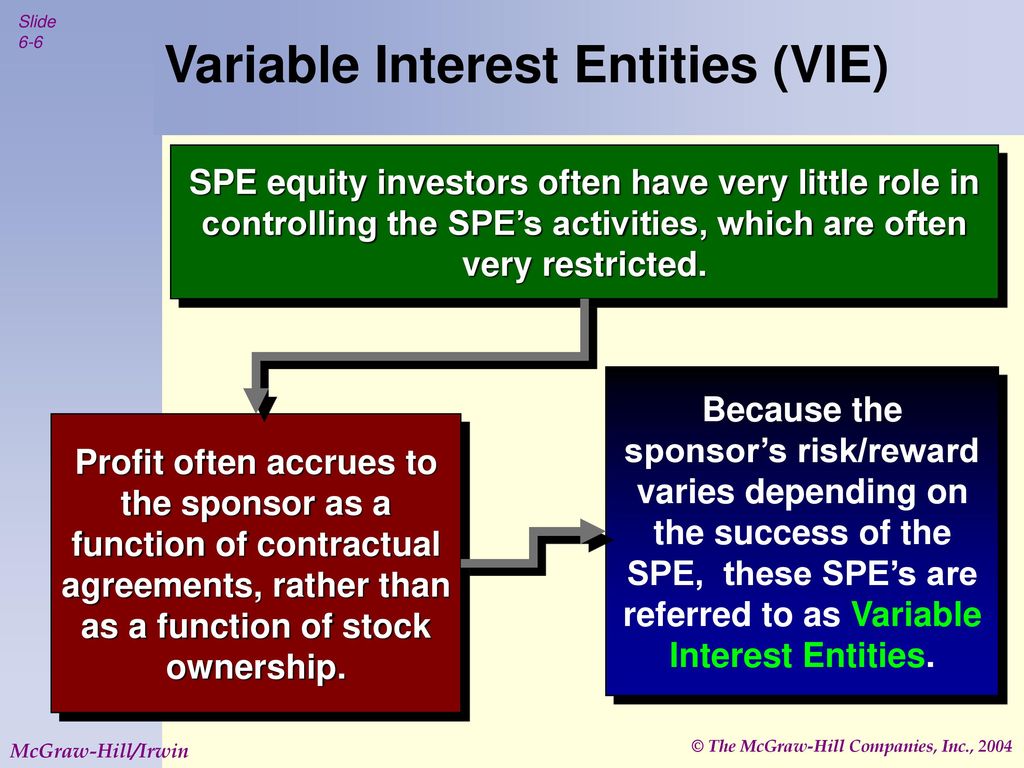

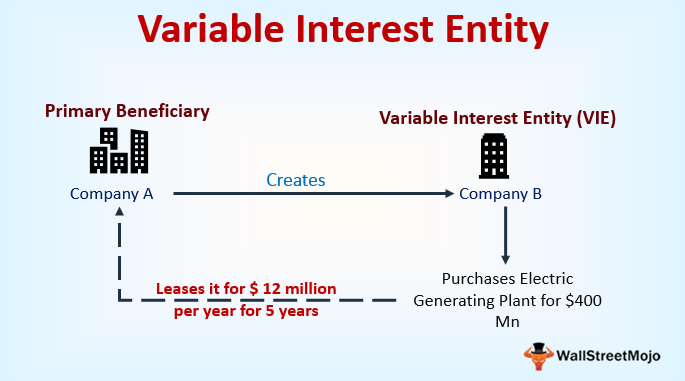

A variable interest entity (VIE) refers to a legal business structure in which an investor has a controlling interest, despite not having a majority of voting rights.

Chapter Six Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues Copyright © 2015 McGraw-Hill Education. All rights. - ppt download

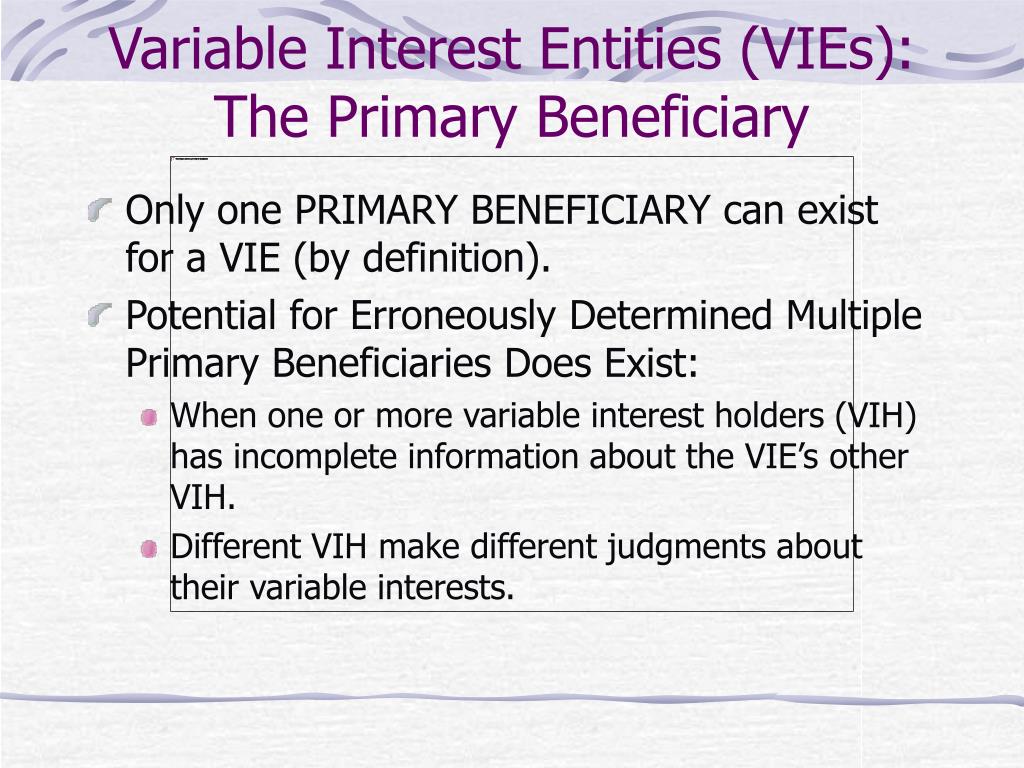

5.1 Identifying the primary beneficiary of a VIE

PPT - Variable Interest Entities PowerPoint Presentation, free download - ID:6666405

Full article: Variable interest entity structures in China: are legal uncertainties and risks to foreign investors part of China's regulatory policy?

Chapter Six Variable Interest Entities, Intercompany Debt, and Other Consolidation Issues. - ppt download

Dheeraj on X: variable Interest Entity (VIE) Definition & Examples with Explanation #variableInterestEntity / X

Heads Up — FASB finalizes targeted amendments to the related-party guidance for variable interest entities

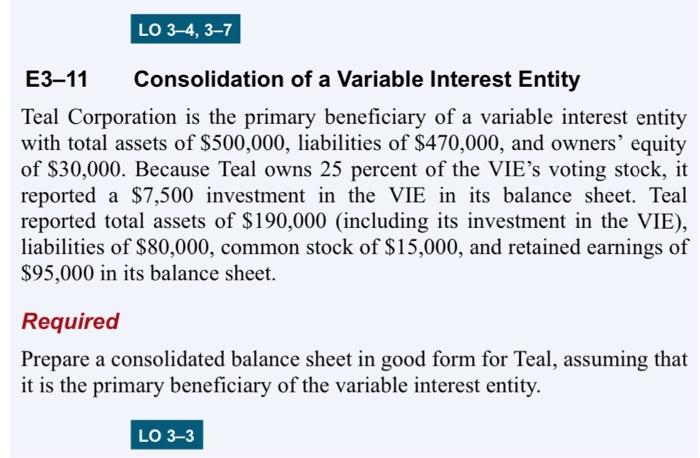

Solved E3-11 Consolidation of a Variable Interest Entity

Investor Bulletin: U.S.-Listed Companies Operating Chinese Businesses Through a VIE Structure

Recomendado para você

-

:max_bytes(150000):strip_icc()/gametheory-072c88d1036741f180469734832a6d14.png) Game Theory06 julho 2024

Game Theory06 julho 2024 -

The Meaning and Origin of Press F to Pay Respects - VGKAMI06 julho 2024

The Meaning and Origin of Press F to Pay Respects - VGKAMI06 julho 2024 -

Why is press F to pay respects a thing? : r/OutOfTheLoop06 julho 2024

Why is press F to pay respects a thing? : r/OutOfTheLoop06 julho 2024 -

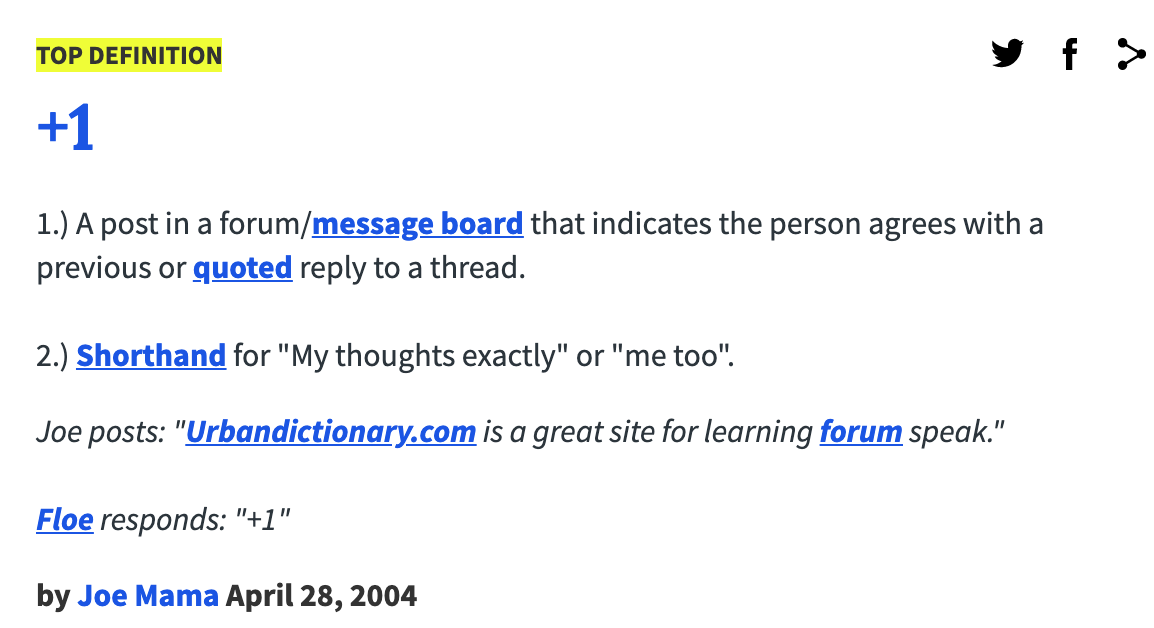

Urban Dictionary, +106 julho 2024

Urban Dictionary, +106 julho 2024 -

Urban Dictionary's Top Definition, Mutt's Law06 julho 2024

Urban Dictionary's Top Definition, Mutt's Law06 julho 2024 -

:max_bytes(150000):strip_icc()/liquiditypreference.asp-final-61b55e392c86409fb0b4cf0e2315bd40.jpg) Theory of Liquidity Preference Definition: History, Example, and06 julho 2024

Theory of Liquidity Preference Definition: History, Example, and06 julho 2024 -

What is a 'thot'? Meaning and origin explained06 julho 2024

What is a 'thot'? Meaning and origin explained06 julho 2024 -

TikTok slang explained: FYP, POV, PFP – What do they mean? - Dexerto06 julho 2024

TikTok slang explained: FYP, POV, PFP – What do they mean? - Dexerto06 julho 2024 -

What Is a Database? (Definition, Types, Components)06 julho 2024

What Is a Database? (Definition, Types, Components)06 julho 2024 -

:max_bytes(150000):strip_icc()/rateofchange.asp-final-f20db45c203b4651b8bdcd6d34b3d6d1.png) Rate of Change Definition, Formula, and Importance06 julho 2024

Rate of Change Definition, Formula, and Importance06 julho 2024

você pode gostar

-

Assustador png06 julho 2024

Assustador png06 julho 2024 -

La Promotion on X: Game The Last Of Us Part I - PS5 - R$ 89,9906 julho 2024

La Promotion on X: Game The Last Of Us Part I - PS5 - R$ 89,9906 julho 2024 -

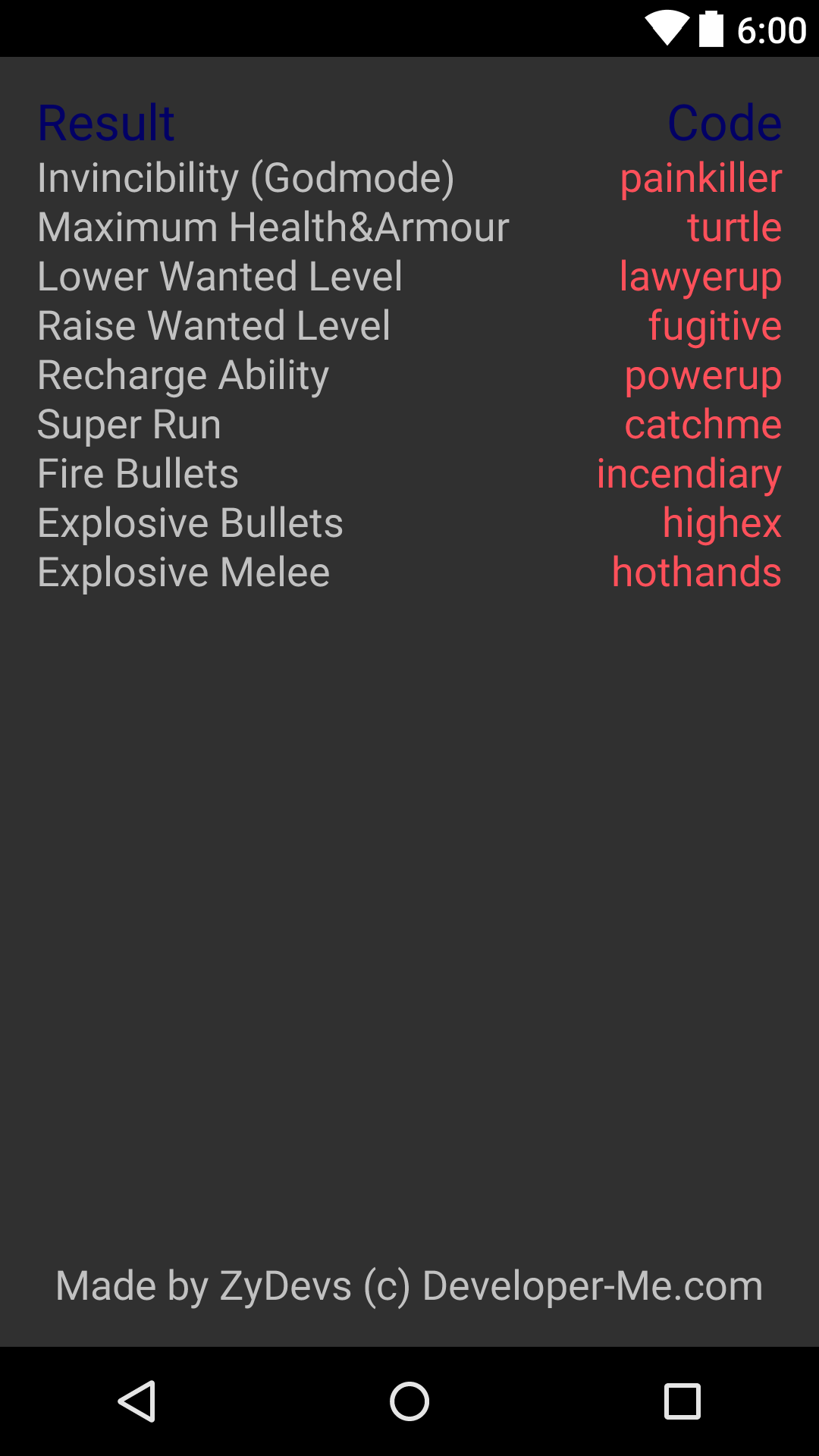

GTA V PC Cheat Codes (Mobile/Android App) - GTA5-Mods.com06 julho 2024

GTA V PC Cheat Codes (Mobile/Android App) - GTA5-Mods.com06 julho 2024 -

Kimetsu no Yaiba T.V. Media Review Episode 1806 julho 2024

Kimetsu no Yaiba T.V. Media Review Episode 1806 julho 2024 -

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2022/C/x/6wzpsJQ4yAtqsTvB3zcg/capa.jpeg) Nubank libera cartão de crédito adicional na conta digital; saiba tudo06 julho 2024

Nubank libera cartão de crédito adicional na conta digital; saiba tudo06 julho 2024 -

Assistência na Tradução do jogo Resident Evil 4: Ultimate HD Edition - Fórum Tribo Gamer06 julho 2024

Assistência na Tradução do jogo Resident Evil 4: Ultimate HD Edition - Fórum Tribo Gamer06 julho 2024 -

Meme Dump - GIF's included Genshin Impact06 julho 2024

Meme Dump - GIF's included Genshin Impact06 julho 2024 -

The Legend Of Zelda In Minecraft - Zelda Dungeon06 julho 2024

The Legend Of Zelda In Minecraft - Zelda Dungeon06 julho 2024 -

jogo de corrida de carros 3d APK (Android Game) - Baixar Grátis06 julho 2024

-

Arifureta: From Commonplace to World's Strongest06 julho 2024

Arifureta: From Commonplace to World's Strongest06 julho 2024