What is FICA Tax? - The TurboTax Blog

Por um escritor misterioso

Last updated 05 julho 2024

Quick Answer: FICA is a payroll tax on earned income that covers a 6.2% Social Security tax and a 1.45% Medicare tax. If you’ve watched “Friends,” you can probably relate to Rachel opening her first paycheck and asking, “Who’s FICA? Why’s he getting all my money?” If you asked, you were probably told it was

Ways to File your Taxes with TurboTax For Free - The TurboTax Blog

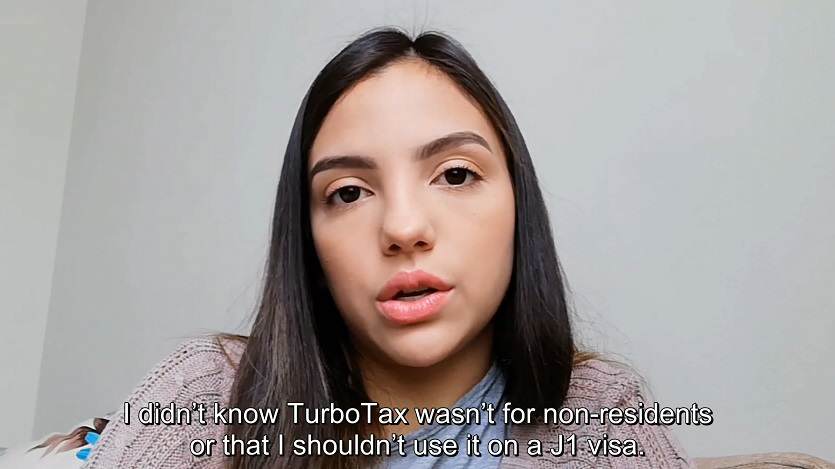

Claiming Your J1 Tax Refund - Turbotax vs Sprintax

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

FICA Tax Exemption for Nonresident Aliens Explained

How Much are Medicare Deductions for the Self-Employed? - The

How to fix your dependent's Social Security number mismatch e-file

TaxTouchdown - The TurboTax Blog

Withholding FICA Tax on Nonresident employees and Foreign Workers

What Are FICA Taxes? – Forbes Advisor

What is FICA Tax? - The TurboTax Blog

The TurboTax Blog It's all about the refund

Do Social Security Income Recipients Pay Income Taxes? TurboTax

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses05 julho 2024

What Is FICA Tax? A Complete Guide for Small Businesses05 julho 2024 -

What are FICA Taxes? 2022-2023 Rates and Instructions05 julho 2024

-

FICA Tax: Understanding Social Security and Medicare Taxes05 julho 2024

-

What is the FICA Tax? - 2023 - Robinhood05 julho 2024

-

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software05 julho 2024

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software05 julho 2024 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social05 julho 2024

-

FICA explained: Social Security and Medicare tax rates to know in 202305 julho 2024

FICA explained: Social Security and Medicare tax rates to know in 202305 julho 2024 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student05 julho 2024

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student05 julho 2024 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books05 julho 2024

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books05 julho 2024 -

Keyword:current fica tax rate - FasterCapital05 julho 2024

Keyword:current fica tax rate - FasterCapital05 julho 2024

você pode gostar

-

Street Fighter V Arcade Edition (PS4) cheap - Price of $12.5105 julho 2024

Street Fighter V Arcade Edition (PS4) cheap - Price of $12.5105 julho 2024 -

Episódio 08 de Shuumatsu no Harem: Data e Hora de Lançamento05 julho 2024

Episódio 08 de Shuumatsu no Harem: Data e Hora de Lançamento05 julho 2024 -

Sleeping Dogs developer working on Triad Wars sequel05 julho 2024

Sleeping Dogs developer working on Triad Wars sequel05 julho 2024 -

Kuro no Shoukanshi (Volume) - Comic Vine05 julho 2024

Kuro no Shoukanshi (Volume) - Comic Vine05 julho 2024 -

Cars ROM - NDS Download - Emulator Games05 julho 2024

Cars ROM - NDS Download - Emulator Games05 julho 2024 -

Everyday feels the same - GIF - Imgur05 julho 2024

Everyday feels the same - GIF - Imgur05 julho 2024 -

Jogo Anatomia (Orgãos e Sistema Corpo Humano) - Loja Grow05 julho 2024

Jogo Anatomia (Orgãos e Sistema Corpo Humano) - Loja Grow05 julho 2024 -

ImVehFt - Improved Vehicle Features - MixMods05 julho 2024

ImVehFt - Improved Vehicle Features - MixMods05 julho 2024 -

When Will 'Attack on Titan' Season 2 Be on Netflix?05 julho 2024

When Will 'Attack on Titan' Season 2 Be on Netflix?05 julho 2024 -

Killua Zoldyck Hunter X Hunter Anime Series Hd Matte Finish Poster05 julho 2024

Killua Zoldyck Hunter X Hunter Anime Series Hd Matte Finish Poster05 julho 2024