Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 05 julho 2024

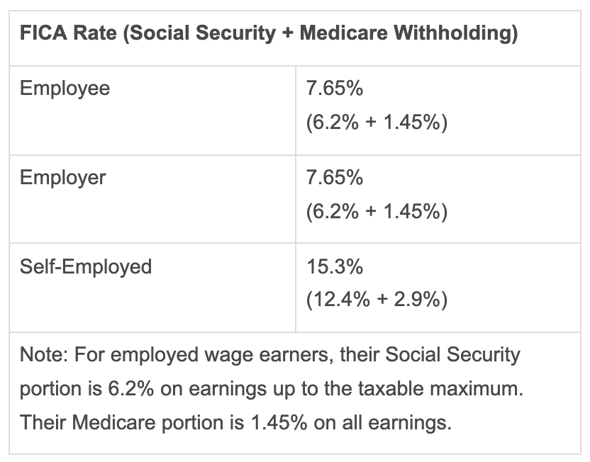

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

Payroll Tax Rates (2023 Guide) – Forbes Advisor

Social Security Administration - “What is FICA on my paycheck

What Is FICA Tax: How It Works And Why You Pay

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

Students on an F1 Visa Don't Have to Pay FICA Taxes —

2021 Wage Base Rises for Social Security Payroll Taxes

Family Finance Favs: Don't Leave Teens Wondering What The FICA?

Medicare Tax: Current Rate, Who Pays & Why It's Mandatory

Social Security Administration's Master Earnings File: Background

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

What Are FICA Taxes And Why Do They Matter? - Quikaid

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses05 julho 2024

What Is FICA Tax? A Complete Guide for Small Businesses05 julho 2024 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks05 julho 2024

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks05 julho 2024 -

What are FICA Tax Payable? – SuperfastCPA CPA Review05 julho 2024

What are FICA Tax Payable? – SuperfastCPA CPA Review05 julho 2024 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations05 julho 2024

What is a payroll tax?, Payroll tax definition, types, and employer obligations05 julho 2024 -

Do You Have To Pay Tax On Your Social Security Benefits?05 julho 2024

Do You Have To Pay Tax On Your Social Security Benefits?05 julho 2024 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software05 julho 2024

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software05 julho 2024 -

What is the FICA Tax Refund? - Boundless05 julho 2024

What is the FICA Tax Refund? - Boundless05 julho 2024 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student05 julho 2024

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student05 julho 2024 -

What Is FICA Tax, Understanding Payroll Tax Requirements05 julho 2024

What Is FICA Tax, Understanding Payroll Tax Requirements05 julho 2024 -

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset05 julho 2024

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset05 julho 2024

você pode gostar

-

Chess Terminology You Should Know: Piece Values (Part 7) #chess #chess05 julho 2024

-

A Void, Trouble Lyrics - CMOI - Only on JioSaavn05 julho 2024

A Void, Trouble Lyrics - CMOI - Only on JioSaavn05 julho 2024 -

✓QUIZ DO CLUBE DE XADREZ ONLINE✓ 105 julho 2024

-

Metal Sonic, Furnace, and Chaos Sonic Meme by Brokenhollowglass on05 julho 2024

Metal Sonic, Furnace, and Chaos Sonic Meme by Brokenhollowglass on05 julho 2024 -

Rushing Pixel - Independent game studio, creator of Turn It On!05 julho 2024

Rushing Pixel - Independent game studio, creator of Turn It On!05 julho 2024 -

Vampire: The Masquerade – Coteries of New York - Wikipedia05 julho 2024

Vampire: The Masquerade – Coteries of New York - Wikipedia05 julho 2024 -

GTA San Andreas Remastered cheats for PlayStation, Xbox and PC05 julho 2024

GTA San Andreas Remastered cheats for PlayStation, Xbox and PC05 julho 2024 -

Un Verano Con los Duendes (Paperback)05 julho 2024

Un Verano Con los Duendes (Paperback)05 julho 2024 -

Cavalo pantaneiro pulando05 julho 2024

Cavalo pantaneiro pulando05 julho 2024 -

Sentouin, Hakenshimasu! Episode #1005 julho 2024

Sentouin, Hakenshimasu! Episode #1005 julho 2024