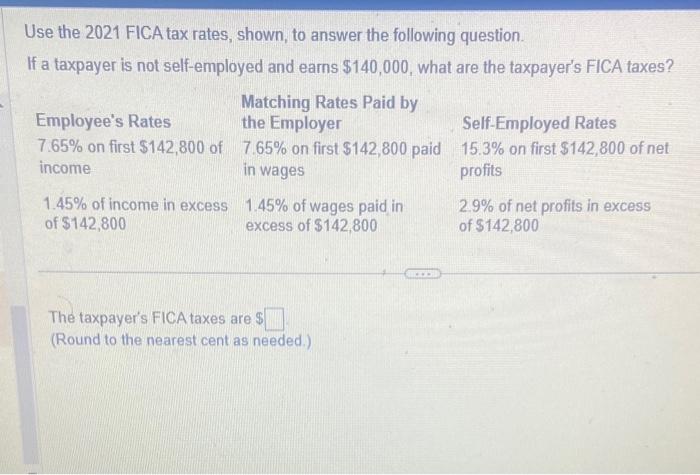

2021 FICA Tax Rates

Por um escritor misterioso

Last updated 05 julho 2024

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Social Security Announces 2020 Taxable Wage Base - HRWatchdog

Reliance on Social Insurance Tax Revenue in Europe

Maximum Taxable Income Amount For Social Security Tax (FICA)

Medicare Tax: Current Rate, Who Pays & Why It's Mandatory

What is FICA Tax? - Optima Tax Relief

Historical Social Security and FICA Tax Rates for a Family of Four

What are the major federal payroll taxes, and how much money do they raise?

Understanding Medicare Tax

2021 FICA Tax Rates

Federal Insurance Contributions Act - Wikipedia

Solved Use the 2021 FICA tax rates, shown, to answer the

Employers: The Social Security Wage Base is Increasing in 2022

The Evolution of Social Security's Taxable Maximum

Recomendado para você

-

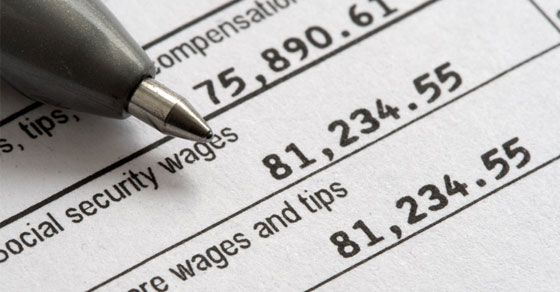

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes05 julho 2024

Learn About FICA, Social Security, and Medicare Taxes05 julho 2024 -

What Is FICA Tax: How It Works And Why You Pay05 julho 2024

What Is FICA Tax: How It Works And Why You Pay05 julho 2024 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes05 julho 2024

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes05 julho 2024 -

Overview of FICA Tax- Medicare & Social Security05 julho 2024

Overview of FICA Tax- Medicare & Social Security05 julho 2024 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and05 julho 2024

-

What it means: COVID-19 Deferral of Employee FICA Tax05 julho 2024

What it means: COVID-19 Deferral of Employee FICA Tax05 julho 2024 -

Vola05 julho 2024

Vola05 julho 2024 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine05 julho 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine05 julho 2024 -

2019 US Tax Season in Numbers for Sprintax Customers05 julho 2024

2019 US Tax Season in Numbers for Sprintax Customers05 julho 2024 -

FICA Tax Tip Fairness Pro Beauty Association05 julho 2024

FICA Tax Tip Fairness Pro Beauty Association05 julho 2024

você pode gostar

-

Thor: Love and Thunder Chris Hemsworth anuncia ultimas gravaes05 julho 2024

Thor: Love and Thunder Chris Hemsworth anuncia ultimas gravaes05 julho 2024 -

Kimi no Na wa (Your Name): 5 Motivos para assistir o anime - Aficionados05 julho 2024

Kimi no Na wa (Your Name): 5 Motivos para assistir o anime - Aficionados05 julho 2024 -

Facebook whistleblower warns Metaverse will repeat 'all the harms05 julho 2024

Facebook whistleblower warns Metaverse will repeat 'all the harms05 julho 2024 -

Galaxy Note10 & Note10+ Overall Performance05 julho 2024

Galaxy Note10 & Note10+ Overall Performance05 julho 2024 -

4 semanas atrás Meo pau ta duru - iFunny Brazil05 julho 2024

4 semanas atrás Meo pau ta duru - iFunny Brazil05 julho 2024 -

Jogos de Salão de Beleza - Jogos para Meninas05 julho 2024

Jogos de Salão de Beleza - Jogos para Meninas05 julho 2024 -

Kansas State wins 2022 Dr Pepper Big 12 Football Championship - Big 12 Conference05 julho 2024

Kansas State wins 2022 Dr Pepper Big 12 Football Championship - Big 12 Conference05 julho 2024 -

Decoração de Mesa Flork Meme c/8 unid Festcolor05 julho 2024

Decoração de Mesa Flork Meme c/8 unid Festcolor05 julho 2024 -

Enderscape Mod (1.19, 1.18.2) – New Content to The End05 julho 2024

Enderscape Mod (1.19, 1.18.2) – New Content to The End05 julho 2024 -

The God Of Highschool is officially ended in webtoon application : r/manhwa05 julho 2024

The God Of Highschool is officially ended in webtoon application : r/manhwa05 julho 2024